Need to know:

- More employers are recognising the importance of supporting employees’ financial wellbeing in the workplace with education programmes.

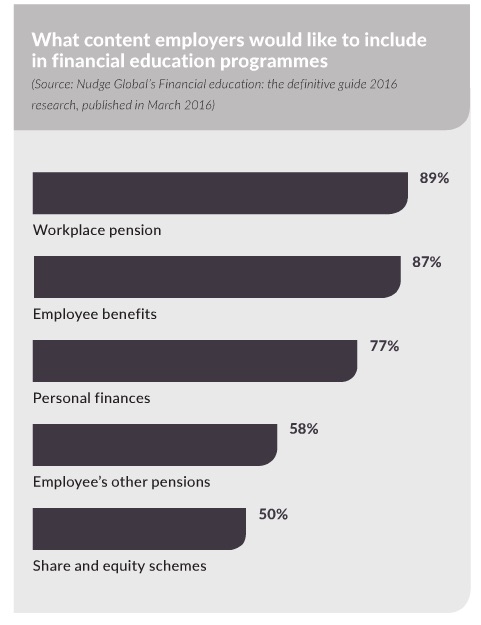

- Financial education programmes should cover a broad range of financial topics.

- Determining the issues that are important among staff can be a sensitive task, so it can be more effective to let employees self-select programmes that are relevant to them.

Offering employees financial education in the workplace is a practice that is growing in popularity. According to Nudge Global’s Financial education: the definitive guide 2016 research, published in March 2016, 50% of respondents are considering introducing a financial wellbeing programme, compared to 20% in 2014. Meanwhile, the number of employers that are not supporting employees’ financial wellbeing has fallen from 7% in 2014 to just 1% in 2016.

The research also found that there is a broad range of drivers that are influencing employers’ decisions to introduce a financial education programme, from the number of pension changes that require greater understanding, to a focus on employee wellbeing.

Financial education is a benefit that is both valued by employees and valuable to the employer in the sense that employees are able to gain a better understanding of how to manage their money, or more effectively plan for their retirement, thereby helping to keep the talent pipeline and succession plans moving.

But what do employers need to include in a financial education programme to ensure it meets the needs and requirements of a broad range of employees? The employer needs to have a clear plan in mind, says Jo Thresher, head of Money at Work at Jelf Employee Benefits. “There’s still a toss-up of responsibility between employees and employers. Employees still think it’s down to employers to help them with money, tax, and decisions, mainly with pensions, but that’s not the case,” she says. “If the employer doesn’t educate the employee that [this responsibility] is up to them, they will be in trouble.

“The employer doesn’t believe it is its responsibility; it isn’t wholly its responsibility but if it educates [employees], perhaps the employee can start to engage. Otherwise, they’ve got the pension freedom and choices, but if they’ve got no money, they’ve got no choice.”

Financial education should, therefore, be about learning to do things differently, adds Thresher.

Programme content and delivery

Prior to implementing a programme, an employer should decide what content to include and how to deliver it. Employers might want to consider what the key financial issues are among staff. This can consist of push and pull issues, says Jonathan Watts-Lay, a director at Wealth at Work.

“Some of the stuff [employers] will need to push out is often around the benefits they offer, for example, if they’re offering a pension, share schemes, salary sacrifice [arrangements and] voluntary benefits,” he explains. “A lot of that employees don’t really understand, but the employer has put in place, presumably for a reason, so the employer needs to have a ‘push’ strategy to make sure all employees understand what is available.”

The pull aspect comes from an issue an individual might have, and want to pull on sources for more information. However, employers need to think about how explicit or otherwise they can be in presenting staff with financial education. For example, individuals might not want their employer to be aware that they have debt problems, so the employer’s responsibility will go as far as blanket communications to all staff informing them of seminars or workshops, for example.

Watts-Lay says: “It’s then down to the individual to make that decision as to whether they think it will be worthwhile them attending. Whereas if it’s at retirement, for example, it can be much more personalised. For example, where a person has reached the age of 55, so they could retire and take their money, it’s quite right to be explicit and say: you’re now at an age when you might want to consider retirement, or taking money out of your pension. [Employers] can be far more targeted with that second group than with the first because of the [different levels of] sensitivity.”

Financial education providers can see a spectrum of issues among employees and, in turn, for employers that want to offer support. This could be help with managing or saving money, help to get on the housing ladder or debt, or it could be high earners and changes to the annual allowance.

Looking at various elements of employee data can also give an indication of the financial issues that are important among a workforce. Andrew Woolnough, value proposition director at Willis Towers Watson, says: “At a strategic level, [employers] are mapping out the risks associated with their employees with regards to financial wellbeing. It allows them to start collecting data and joining things up. For example, it could be people are making stress claims on the employer’s liability, income protection or private medical [insurance schemes].

“The forward-thinking employers are now looking at reported short-term absenteeism data, linking that through to their talent, succession planning and age profile. It’s joining the dots together so they can be proactive. Financial wellbeing is split across HR, health and safety, risk, finance and payroll. It’s a corporate risk and impacts the entire organisation from profitability to productivity.”

Effective implementation

Deciding on the target audience is a key part of the implementation of a financial education programme, but segmenting the workforce into different demographics is not the only solution. Darren Laverty, partner at Secondsight, says: “Everybody is uniquely different in terms of their financial savvy, their education, their background, their stage of life. It’s too variable to try and segment and to get right. We found [employees] don’t know what they need to know; we’ve had to step right back and say, ‘let’s get people aware of what they need to be educated about’.”

As a starting point, employers could offer a presentation to as many employees as possible, which will run through lots of different financial topics, such as retirement planning, debt, mortgages, investment and estate planning. Employees can then choose to attend workshops on the topics they feel are most relevant to them, says Laverty.

“The employer feels [it is] doing as much as [it] can if [it] can drive people in to this presentation, and then offer the opportunity to attend more detailed workshops on relevant topics to them, whether they take it or leave it, it’s up to them, but at least the employer feels [it has] done what [it] can to help them,” he adds.

Although financial education in the workplace is a valuable benefit, it can help to exacerbate the advice gap, whereby people want financial advice, but can’t afford it. It could be argued that financial education effectively puts more employees into that gap because they have more information about their financial wellbeing.

However, there are ways to bridge the gap in the workplace, says Laverty. “It might be an online financial education portal, the [employee] might just need a will, or they might just need a query answered,” he says. “The number-one thing is helping people understand what it is they need to learn about.”

Coventry University supports employees’ financial wellbeing with education programmes

Coventry University supports employees’ financial wellbeing with education programmes

Coventry University refreshed its financial education programme to help support employees with their financial understanding and also promote awareness of the organisation’s total reward package.

In June 2015, the university introduced pilot financial education workshops in response to a number of factors: employees were taking more interest in their own financial wellbeing; the pace and complexity of pension changes; and a desire to create greater engagement among employees with its total reward package.

Renu Birla, rewards strategy manager, says: “[This] all led us to the conclusion that we really needed to offer our employees financial workshops that would enable them to take more ownership of their own financial wellbeing. The workshops were intended to offer guidance and support employees in making their own decisions, whichever life stage they were at. They also raised awareness of the value, choice and flexibility of the individual benefits that we offer at the university so that employees could leverage them to make savings or gain other advantages.”

The university chose a face-to-face workshop style in order to enable open discussion among employees. The content was agreed with the provider because the university wanted to ensure that staff got an independent view, but it also canvassed the views of employees. Birla explains: “As part of the pilot, we sent out pre-evaluation surveys to find out from employees what they wanted to achieve from the workshops. We also asked them after they attended the pilots did they feel they met their objectives. Their responses informed the design of the programme going forward.

“The feedback from all those that attended was that they found the workshops incredibly useful, both in the way that we’ve designed them, and the fact that they focused on take-away points and actions that they could follow up on going forward.”

After positive feedback from employees that attended the pilots, the university introduced a full financial education programme, provided by Wealth at Work, that runs each spring and autumn. It focuses on different life stages: those employees just starting out; those with more commitments that want support in managing finances; and those getting ready for an easier life [in the run-up to retirement]. It also offers a specific separate programme on retirement planning, mainly for those up to 10 years away from retirement.

Employee feedback from the pilot and workshops so far has been extremely positive. Birla says: “Employees appreciated getting a one-stop shop including what the whole university package is all about. Second, across the board, they appreciated the open-forum discussion workshop, so people were almost learning from each other. They also felt they had improved their understanding of the choices they had under the pension scheme. They definitely felt that they left knowing how they could keep on board and updated, it was something ongoing.

“It’s really about [employees’] financial wellbeing and trying to get them into that discipline of looking at it on an ongoing basis from the start of their career. It also gave us a platform to make sure that they realise the value of the total reward package we offer, everything from training and development to cash benefits,” adds Birla.